- Q Insights

- Posts

- Q Insights #005

Q Insights #005

From ESG to ESD: The Rise Of “Strategic Disruption”

Q Insights is brought to you by KanataQ

This week’s read time: 5 minutes

Welcome to this edition of Q Insights — our bi-weekly newsletter for sustainability and ESG professionals looking to make smarter solution decisions.

Each edition brings you concise, relevant updates on the tools, trends, and technologies driving the sustainable transition. We filter the noise, highlight what matters, and help you navigate the sustainability solution landscape with clarity and confidence.

In this edition, we’ll cover:

• Q Intelligence: 50% of ESG Solutions Are Now European 📊

• Q Thought Piece: From ESG to ESD: The Rise Of “Strategic Disruption” - thought piece by Nawar Alsaadi 💬

• Q Signals: Datamaran launched Datamaran Core, CO2AI introduced a suite of AI-powered agents to help sustainability teams, Wolters Kluwer unveiled two new ESG data solutions, and other news 📊

• KanataQ Corner: New Listed Providers and Ecosystem Partners announced ✅

• and other insights 💡

Q INTELLIGENCE

Europe Has Taken the Lead in the ESG Race!

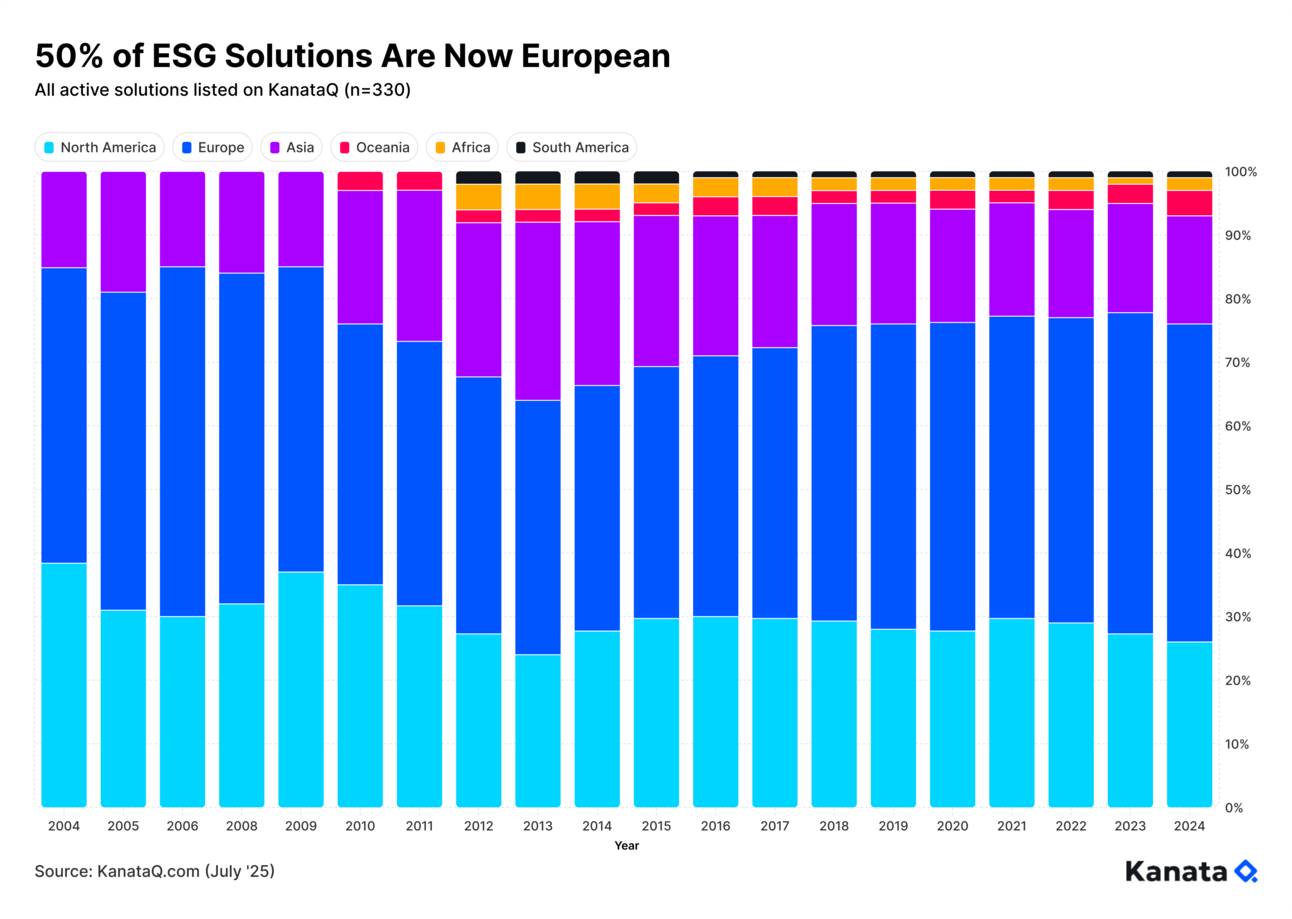

ESG has truly gone global, but the latest figures from KanataQ reveal a striking shift: since 2023, half of all active ESG solutions have hailed from Europe. Back in 2014, North America and Asia combined held 54% of the market, while Europe managed just 39%.

In the years since, Europe’s share has crept up year after year, as North America has lost ground. Asia has stayed remarkably steady in recent years, contributing roughly 20% of solutions annually. Meanwhile, regions such as South America. Oceania, and Africa - once minor players - have quietly entered the market and taken ground since around 2012.

What this tells us is simple: ESG has never belonged to one region, and the race is wide open. Europe may be ahead now, but the market is always shifting - and getting more competitive by the day.

Ready to see who’s shaping the sustainability and ESG market? Dive into the full roster of 330 ESG data, software, and consultant solutions at kanataq.com, and stay one step ahead.

Q THOUGHT PIECE

From ESG to ESD: The Rise Of “Strategic Disruption”

By Nawar Alsaadi

Ten years ago, ESG felt like a revolution. After decades of siloed philanthropy and footnote disclosures, we finally had a common language for sustainability. But revolutions age quickly. Today, biodiversity loss is accelerating, global emissions remain on an upward curve, and geopolitical tremors move markets faster than any climate-risk model. The mirror of ESG still shows us where we’ve been, rather than where we are heading.

Last month, the Financial Times captured that unease with a pointed headline: “ESD: an investor framework for an era of upheaval.” The piece argues that investors must now train their sights on Emerging, Strategic, and Disruptive forces if they hope to keep portfolios—and companies—resilient in a poly-crisis world.

ESD introduces an additional layer of non-financial data, some of which intersects with sustainability and the underlying premise of ESG, but also extends beyond it. Emerging factors track early tremors such as drought patterns or murmurings of export bans. Strategic factors operate at the policy–power nexus: carbon border tariffs, forced-labour legislation, quantum computing controls; events that can upend sectors overnight. Disruptive factors represent the exponential technologies that collapse decades of linear forecasting in a single product cycle.

To make these insights actionable, ESD would track and capture metrics such as Innovation Velocity, Digital Resilience Score, Supply Chain Sovereignty Ratio, Geopolitical Risk Footprint, and Regulatory Forecast Readiness. These indicators shift the focus from retrospective reporting to anticipatory strategy, positioning companies to navigate disruption before it becomes a crisis.

ESD aligns closely with the concept of Sustainable Business Intelligence (SBI), which I introduced in a previous newsletter. ESD adds an essential layer of “disruption intelligence” that can be woven into the four constituent layers of SBI, expanding its capacity to guide strategic decision-making in complex and volatile contexts.

To stay ahead, companies must abandon static scorecards in favour of dynamic dashboards that integrate climate signals, supply chain telemetry, and geopolitical risk feeds. KPIs must evolve from disclosure-based outputs to outcome-driven commitments: securing renewable power, derisking sanctioned suppliers, and sourcing recycled critical minerals on clearly defined timelines.

Solution providers must consider how their existing platforms can be repurposed to capture not only sustainability indicators but also real-time disruption signals. The tools we’ve used to measure risk and resilience must evolve. Static metrics and lagging indicators are no longer sufficient in a world where a breakthrough in battery chemistry or a sudden trade sanction can erase billions in market capitalization overnight. Platforms built for ESG management and reporting have an opportunity to evolve into systems for strategic sensing and real time operational planning.

In an increasingly unpredictable and fast-changing world, ESD is not optional. It’s an existential necessity, for sustainability solution users and providers alike.

Q SIGNALS

Latest developments, insights, and trends

📊 New tools, features, and funding rounds from solution providers

Datamaran (KanataQ listed) launched Datamaran Core, a streamlined ESG solution designed to help companies identify, manage, and disclose sustainability-related risks and opportunities. Aimed at sustainability, legal, and risk teams, Core offers key tools like materiality assessments, a double materiality evaluation module, regulatory monitoring, and audit-ready data exports—all without the cost or complexity of a full governance platform. It also includes access to Harbor+, Datamaran’s peer networking and insight-sharing community. (link)

CO2 AI launched a suite of AI-powered agents to help sustainability teams automate emissions data collection, calculation, and cleanup—reducing manual work and accelerating decarbonization. The tools include a Supplier Engagement Agent that pulls emissions data from public sources like CDP and SBTi; a Footprinting Agent that rapidly generates product- and corporate-level footprints with high accuracy; and a pre-release Data Enhancement Agent that cleans and validates emissions data automatically. These agents are designed to solve the widespread problem of fragmented, unreliable data, enabling teams to focus on emissions reduction rather than administrative tasks.

Wolters Kluwer launched two new ESG data solutions to help companies manage EU regulatory compliance and integrate sustainability with financial strategy. The first, CCH Tagetik ESG & Sustainability for CBAM, supports compliance with the EU’s upcoming Carbon Border Adjustment Mechanism (CBAM) by automating emissions tracking, identifying relevant imports, and generating submission-ready reports. The second, CCH Tagetik ESG & Sustainability for Planning & Analytics, connects financial and ESG data to enhance forecasting, simulate emissions impacts, and align sustainability strategies with financial performance. Both tools aim to help businesses anticipate regulatory demands and embed ESG into long-term decision-making.

Climatiq, a Berlin-based “carbon intelligence” solutions provider, raised €10 million in Series A funding to scale its AI-powered emissions data tools. The company embeds automated carbon calculations into over 200 business platforms, helping enterprises measure the impact of activities like freight, manufacturing, and cloud usage using a vast database of 200,000+ emission factors.

KANATAQ CORNER

What’s new on KanataQ?

📈 KanataQ Growing Family

Here is the list of providers that joined KanataQ since our last edition: Impakt IQ (Digital Solutions & Analytics), Confiam (Strategic Advisory Services), Sustainext Digital (Strategic Advisory Services), Matero (Digital Solutions & Analytics, Black Skies Blue (Strategic Advisory Services), Nvalue (Climate Action), myConsole (Reporting & Disclosure), ResultX (Sustainable Operations), and ExpertEcosystem (Strategic Advisory Services).

🔵 New Ecosystem Partners

We’re pleased to welcome Eduardo Alfonso Atehortua Barrero, who joins KanataQ as a Partner. And, Pras Gengatharan, who joins KanataQ as an Associate Partner. As a reminder, KanataQ Ecosystem Partners are a select group of sustainability experts carefully chosen by KanataQ to contribute to the platform's growth and success.

PRESENTED BY GREEN DIGEST

Join +4,300 sustainability professionals who read Green Digest every week

Green Digest is a weekly newsletter for ESG and sustainability professionals, delivering key updates, insights, and analyses. Every Tuesday, we break down the biggest developments across sustainability, climate, regulation, sustainable finance, and more—curated from trusted sources. Fridays alternate between our Interview Series with CSOs and leaders shaping the field, and our Impact Briefs—data-driven analyses of companies’ environmental and social performance.

Subscribe for free and join +4,300 readers from companies like Moody’s, BlackRock, Goldman Sachs, and more.